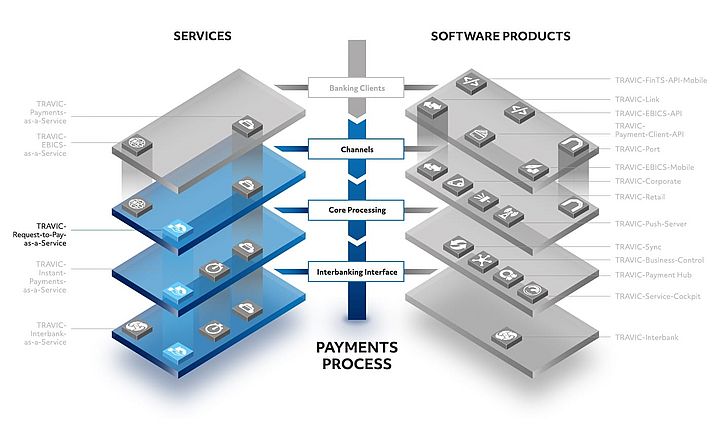

PPI offers you Request to Pay as a service under the name PAYCY – a white-label platform that combines invoice and payment directly in the account. PAYCY enables financial institutions to make considerable savings and increase efficiency through optimised processes. Companies also benefit greatly from PAYCY, as the platform simplifies and automates payment transactions. Make sure your bank supports PAYCY and don't miss the opportunity to benefit from these innovative solutions. Trust in the innovative power of PPI and let PAYCY inspire you.

- Open the searchbox

- Consulting ConsultingConsulting

- Consulting Consulting

- Cross-Border & High-ValueCross-Border & High-Value

- T2 (TARGET2)

- SWIFT gpi

- SWIFT MX

- Global Instant PaymentsGlobal Instant Payments

- Domestic PaymentsDomestic Payments

- Retail PaymentsRetail Payments

- Processes & IT ArchitectureProcesses & IT Architecture

- Regulatory Requirements

- Trends

- Cross-Border & High-Value

- Consulting

- Products ProductsProductsBanking SolutionsInsurance Solutions

- Products Products

- Banking Solutions Banking Solutions

- Insurance Solutions Insurance Solutions

- Products

- Technology & Operations

- About PPI About PPI

- Company Company

- Corporate GroupCorporate Group

- Corporate Social ResponsibilityCorporate Social Responsibility

- Compliance Centre

- Corporate Group

- Touchpoints

- Company

- EN