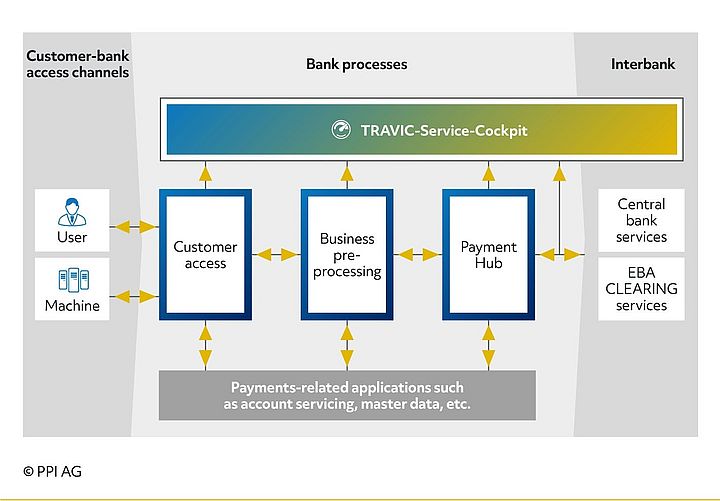

The modular TRAVIC-Service-Cockpit provides financial institutions with an operating environment for all their payments. The monitoring, archiving and reporting functionalities of the cockpit ensure the trouble-free interaction of all connected products and at the same time fulfil the essential regulatory requirements.

- Open the searchbox

- Consulting ConsultingConsulting

- Consulting Consulting

- Cross-Border & High-ValueCross-Border & High-Value

- T2 (TARGET2)

- SWIFT gpi

- SWIFT MX

- Global Instant PaymentsGlobal Instant Payments

- Domestic PaymentsDomestic Payments

- Retail PaymentsRetail Payments

- Processes & IT ArchitectureProcesses & IT Architecture

- Regulatory Requirements

- Trends

- Cross-Border & High-Value

- Consulting

- Products ProductsProductsBanking SolutionsInsurance Solutions

- Products Products

- Banking Solutions Banking Solutions

- Insurance Solutions Insurance Solutions

- Products

- Technology & Operations

- About PPI About PPI

- Company Company

- Corporate GroupCorporate Group

- Corporate Social ResponsibilityCorporate Social Responsibility

- Compliance Centre

- Corporate Group

- Touchpoints

- Company

- EN