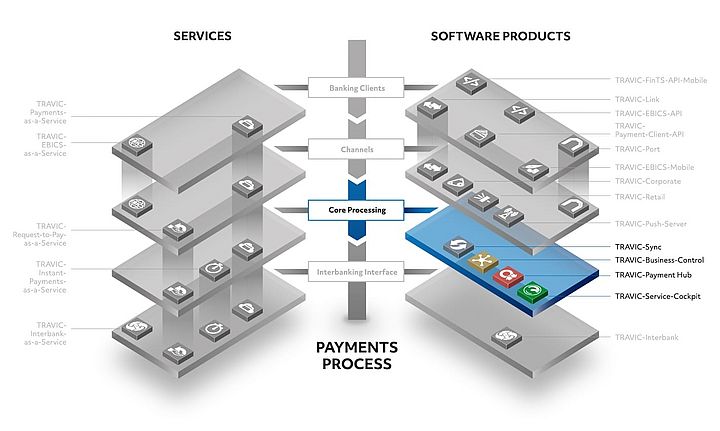

The growing payments transaction volume due to internationalisation and digitalisation poses new challenges for the international financial sector. Across Europe, and soon worldwide, customers expect account-to-account payments that are available to the recipient in seconds. This will not work via the concentrators that have been common up to now, and the direct connections of point of sale/financial institution are predictably increasing. Often an API system is used. The new core processing systems developed by PPI were designed precisely for this scenario and are capable of processing global payments in a fail-safe and legally secure manner.

- Open the searchbox

- Consulting ConsultingConsulting

- Consulting Consulting

- Cross-Border & High-ValueCross-Border & High-Value

- T2 (TARGET2)

- SWIFT gpi

- SWIFT MX

- Global Instant PaymentsGlobal Instant Payments

- Domestic PaymentsDomestic Payments

- Retail PaymentsRetail Payments

- Processes & IT ArchitectureProcesses & IT Architecture

- Regulatory Requirements

- Trends

- Cross-Border & High-Value

- Consulting

- Products ProductsProductsBanking SolutionsInsurance Solutions

- Products Products

- Banking Solutions Banking Solutions

- Insurance Solutions Insurance Solutions

- Products

- Technology & Operations

- About PPI About PPI

- Company Company

- Corporate GroupCorporate Group

- Corporate Social ResponsibilityCorporate Social Responsibility

- Compliance Centre

- Corporate Group

- Touchpoints

- Company

- EN